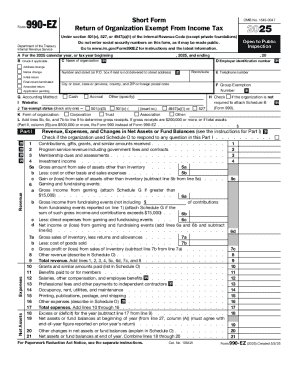

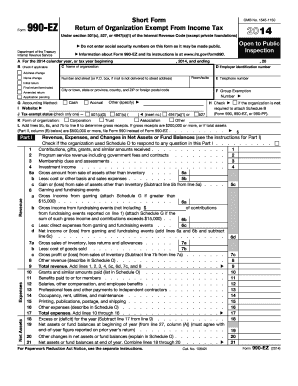

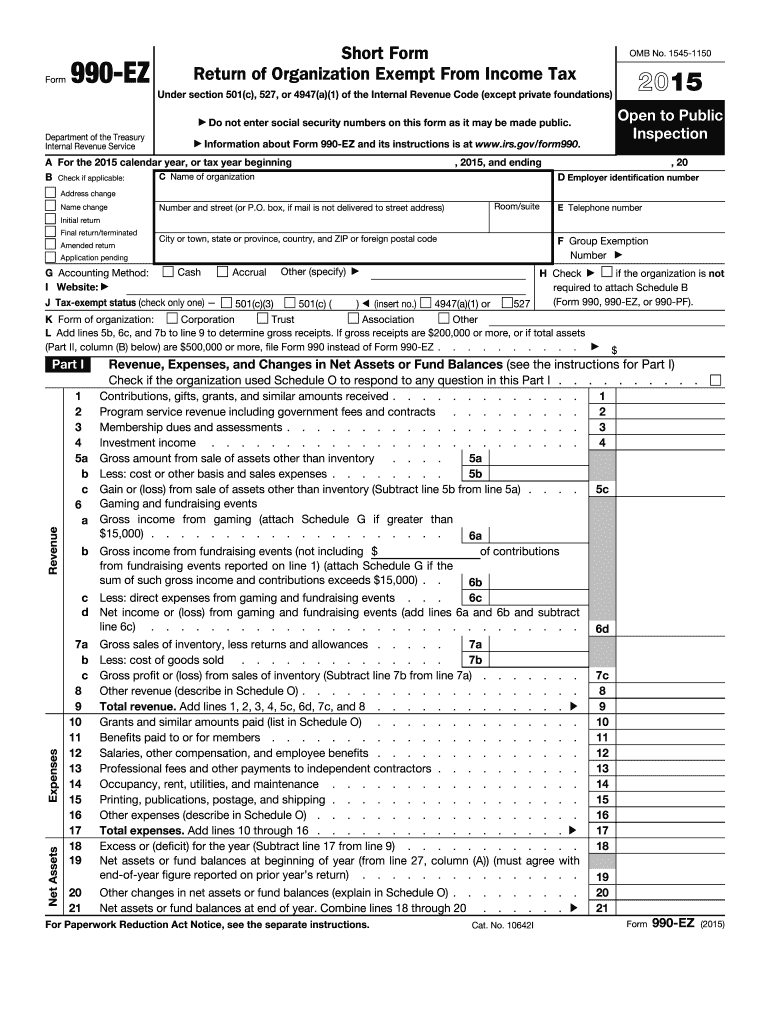

IRS 990-EZ 2015 free printable template

Instructions and Help about IRS 990-EZ

How to edit IRS 990-EZ

How to fill out IRS 990-EZ

About IRS 990-EZ 2015 previous version

What is IRS 990-EZ?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What information do you need when you file the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about IRS 990-EZ

What should I do if I realize I made a mistake after submitting my IRS 990-EZ?

If you've made an error after filing your IRS 990-EZ, you can correct it by submitting an amended return using Form 990-EZ. It's advisable to clearly indicate that it's an amended return to prevent confusion, and to attach a detailed explanation of the changes made. Keep a copy of the amendment for your records.

How can I track the status of my IRS 990-EZ submission?

To track the status of your IRS 990-EZ submission, you can use the IRS 'Where's My Refund?' tool if you filed electronically. If you submitted by mail, allow at least 30 days before inquiring. Always have your details handy to verify your submission status efficiently.

Are there specific security measures I should take when e-filing my IRS 990-EZ?

When e-filing your IRS 990-EZ, ensure that you use a secure and trusted software platform which complies with IRS requirements. Protect your personal and financial information by using strong passwords and maintaining updated antivirus software on your devices.

What should I do if I receive an IRS notice regarding my submitted IRS 990-EZ?

If you receive an IRS notice about your IRS 990-EZ, read it carefully to understand the reason for the communication. Gather any supporting documents that are relevant and respond in a timely manner, addressing the specific issues mentioned to avoid further complications.

What common errors should I be aware of when filing my IRS 990-EZ?

Common errors when filing IRS 990-EZ include incorrect tax identification numbers, misreported income amounts, and failing to include necessary attachments. Review your entries for accuracy before submitting, and double-check that all required components are attached to reduce the chances of having your filing rejected.

See what our users say